How much can i borrow on a shared ownership mortgage

Offset calculator see how much you could save. You prepay or finance a lump sum upfront plus annual.

Looking At Credit Stuff And Was Wondering How Accurate This Was Improve Credit Score Improve Credit Credit Score Infographic

You only pay a mortgage and deposit on the share you own.

. A Retirement Interest Only Mortgage can be used to repay an existing mortgage. Your lender may have other processes or steps they can do to help you recover your mortgage. This typically costs about 1000.

Buying part of a property through shared ownership is one way of getting a foot on that first rung of the ladder a ladder thats become harder to climb as property prices continue to soar. Use our offset calculator to see how your savings could reduce your mortgage term or monthly payments. This guide sets out how the scheme works in England who can take part and.

If youre a first time buyer saving a big deposit can be tricky. You buy a share usually 25-75. Mortgage calculator Mortgage repayment calculator Stamp duty.

The amount of your deposit and how much you can set aside for monthly mortgage payments. The amount you are able to borrow will help you determine the size. Well show you the maximum amount your client could borrow on both a 2 and 5 year product without the need to look up the rates.

You buy a share usually 25-75. Its different to a residential mortgage as instead of buying the whole property you buy a share. On that amount a 5 deposit is 12600 and a 15 deposit is 37800.

A timeshare also known as a vacation ownership is a lifetime commitment to paying for annual trips to the same resort or family of resorts. FHA loans require an upfront mortgage insurance premium UPMIP of 175 of the base loan amount to be paid at closing or it can be rolled into your mortgage. To work this out they will look primarily at your annual income and outgoings to see what they think you can afford.

No lenders mortgage insurance. This percentage is interest-free and it is designed to go up to 25000. How much do houses cost.

Simply select the tier they fit. Shared Ownership just with a non-branded name. Shared ownership is a type of mortgage.

The personal information collected. Thats where shared ownership mortgages can help. Well sort out the house and then you can make it a home.

There are extra costs when buying a home including solicitors fees and mortgage arrangement fees. This is a lenders way to calculate how much they are willing to let you borrow and if they think you can keep up with payments. Deposit from as low as 2.

We wouldnt be able to lend you the mortgage amount requested however you may be able to borrow. Choose a shared ownership home loan designed to help you get into a home of your own sooner. Under the shared ownership program you can purchase a share of your home and pay rent on the remaining mortgage balance until it.

The mortgage amount is based on the information youve provided and doesnt commit us to offer you a mortgage. How much can I borrow. Housing Authority co-own a share of the property with you lowering your loan amount.

You pay rent on the rest. If you own a property as joint tenants you can change your type of ownership to become tenants in common - known as severing a joint tenancy. The longer you wait the harder this process will be.

Shared Ownership Mortgage Products. You are looking to change from your current rate to a new mortgage and borrow more on top of what you owe on your current mortgage. Shared ownership what were referring to on this website The same as Help to Buy.

The Mortgage Store makes getting a mortgage smooth easy and very quick. Please get in touch over the phone or visit us in branch. This is why we pride ourselves on our exceptional 5-star service in.

You can use your first home owner grant FHOG towards your deposit if you build. Mortgage tools and services. Making sure your mortgage is affordable will benefit you and the lender in the long run.

Yet while the concept of shared ownership is straightforward in practice it can be both complicated and expensive. How much can you borrow. Joint mortgages are usually shared by two people but some lenders will allow up to four borrowers.

Shared Ownership is an affordable way to buy a property where you purchase a share of a house that suits you. Get a quick quote for how much you could borrow for a property youll live in based on your financial situation. Get a rough idea of how much you could borrow for a residential mortgage based on your personal circumstances.

Affordability calculator get a more accurate estimate of how much you could borrow from us. Help to Buy Mortgage Products. Military personnel can borrow up to 50 percent of their salaries to buy their first home.

It takes about five to ten minutes. With thousands of different mortgage schemes available in the UK for people with varying circumstances finding the right mortgage deal can be very time-consuming. Buy-to-let calculator see if we could lend you the amount you need for a property youll rent out.

According to the Office of National Statistics in December 2020 the average house price in the UK was 252000. As of December 2020 the average home price in the UK was 251500. Theres also an annual MIP.

Shared Ownership Mortgage Calculator. Youll pay a mortgage on your share then pay rent on the rest.

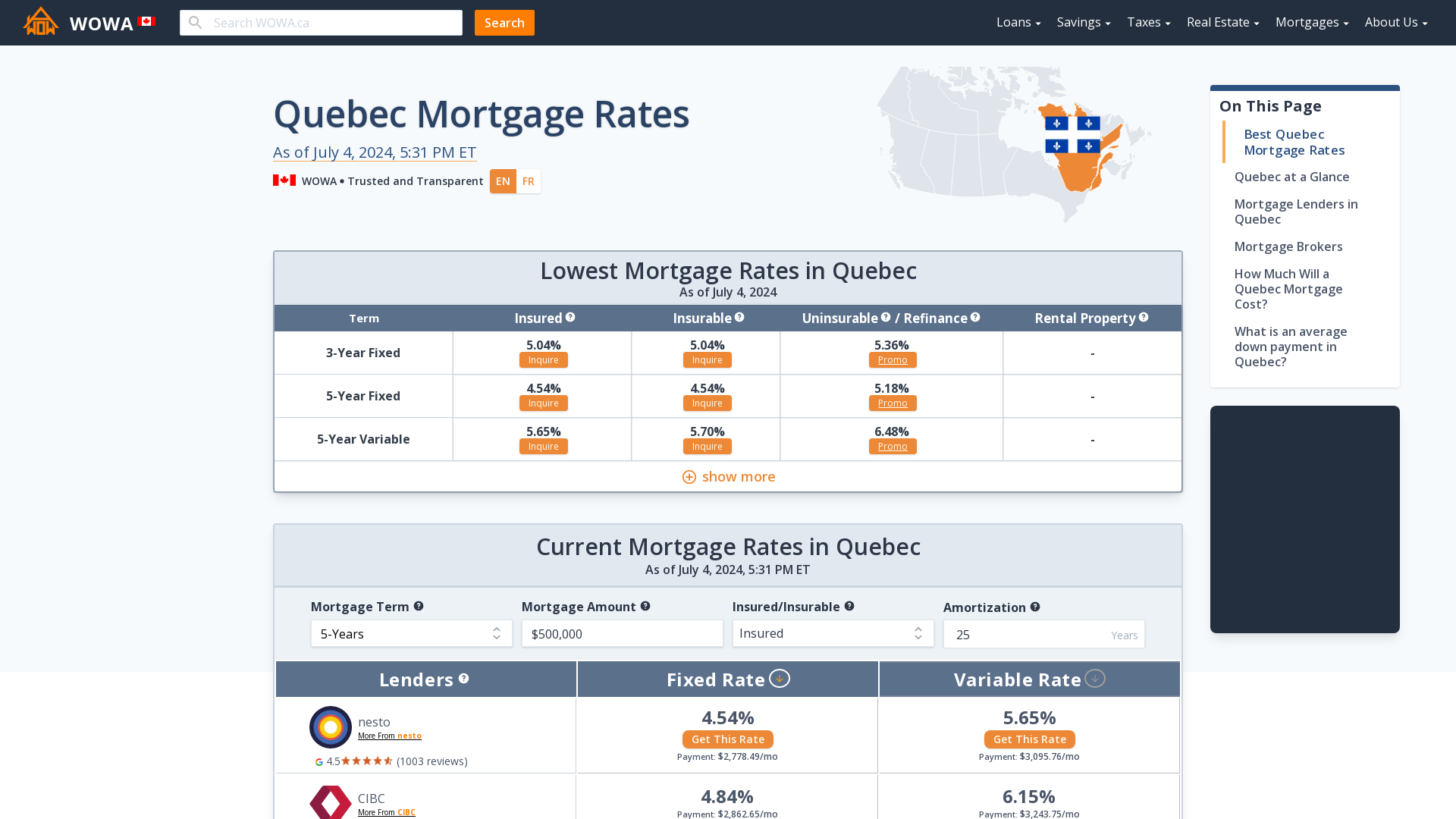

Current Quebec Mortgage Rates Compare The Best Rates From 25 Lenders

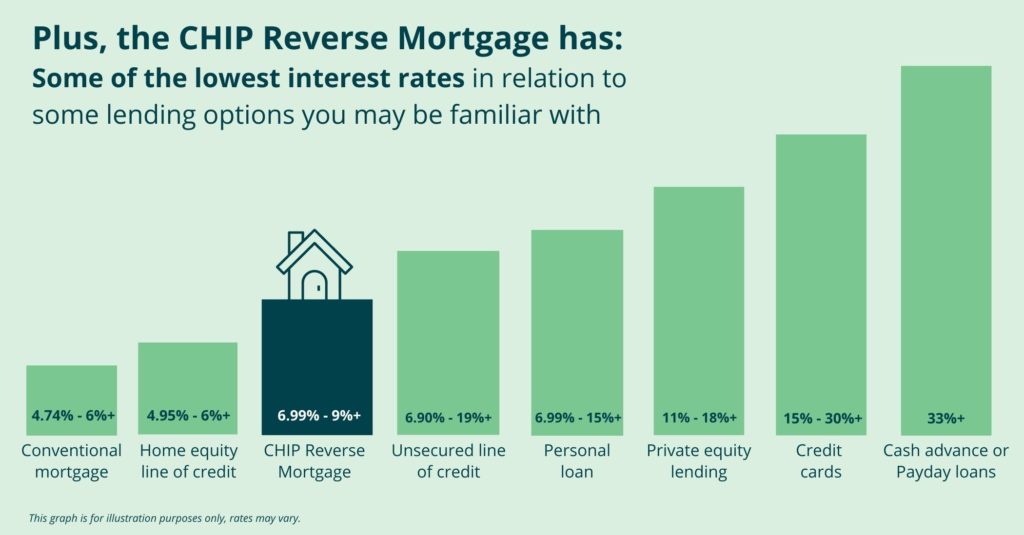

Chip Reverse Mortgage Rates Homeequity Bank

Key Terms To Know In The Homebuying Process Infographic Real Estate With Keeping Current Matters Home Buying Process Home Buying Real Estate Terms

Navigating Joint Mortgages In Canada Nesto Ca

What Is A Joint Mortgage Is It Right For You Dundas Life

Can I Get A Mortgage Canada How To Qualify

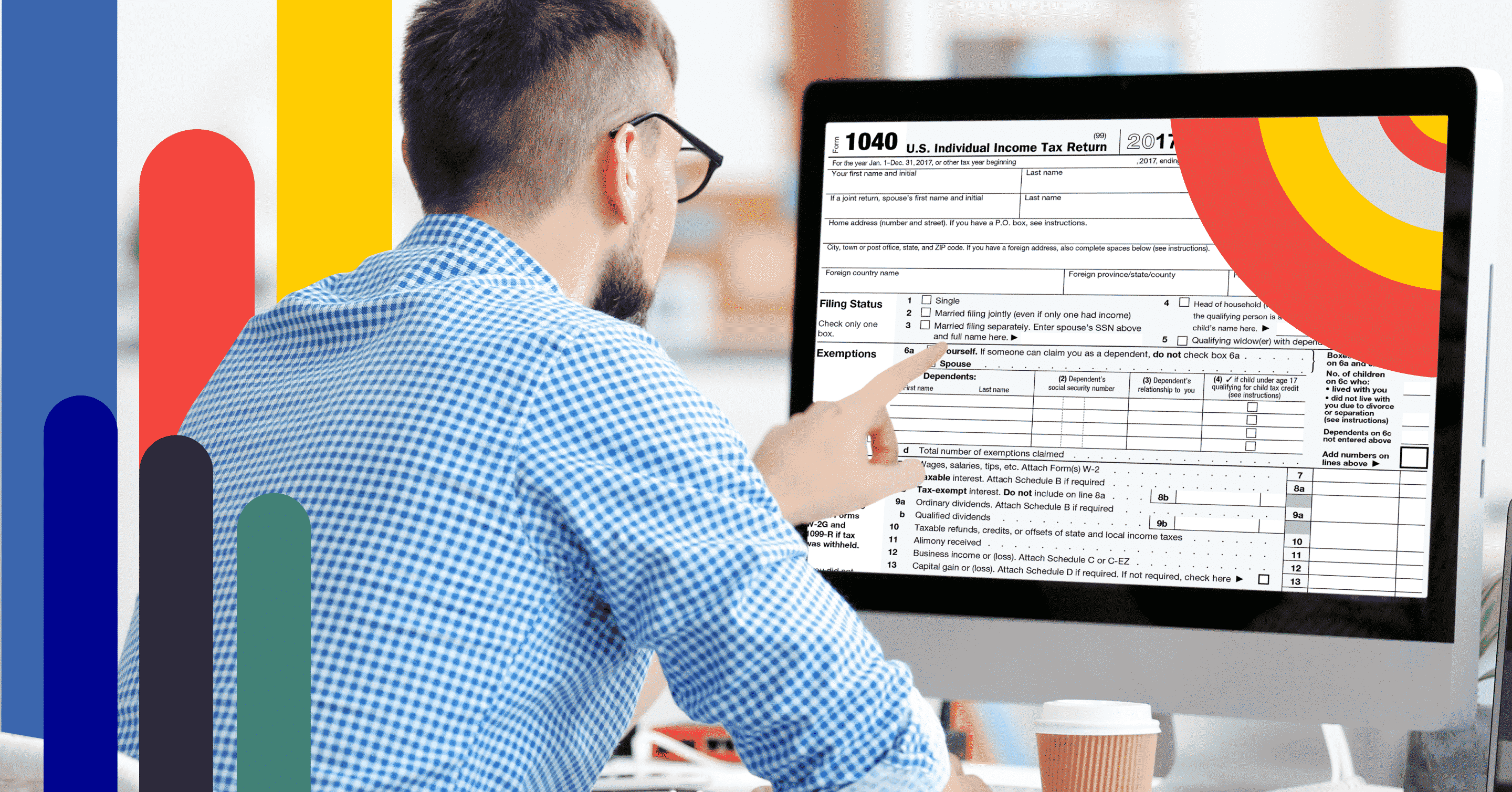

Is Mortgage Interest Tax Deductible In Canada Nesto Ca

Kentucky Fha Loans Compared To Kentucky Conventional Loans Kentucky First Time Home Buyer Programs For 2018 Fha V Fha Loans Conventional Loan Mortgage Loans

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

/whats-difference-between-secured-line-credit-and-unsecured-line-credit-v1-b78ddb9683b24ef2bc31743c5b3b13d2.png)

Secured Vs Unsecured Lines Of Credit What S The Difference

Canadian Reverse Mortgage Frequently Asked Questions Homewise

Pin On Housing Market

Rbc Homeline Plan Mortgage Home Equity Line Rbc Royal Bank

What Is Home Equity Wowa Ca

First Time Home Buyer In Ontario With Low Income Woodstreet Mortgage

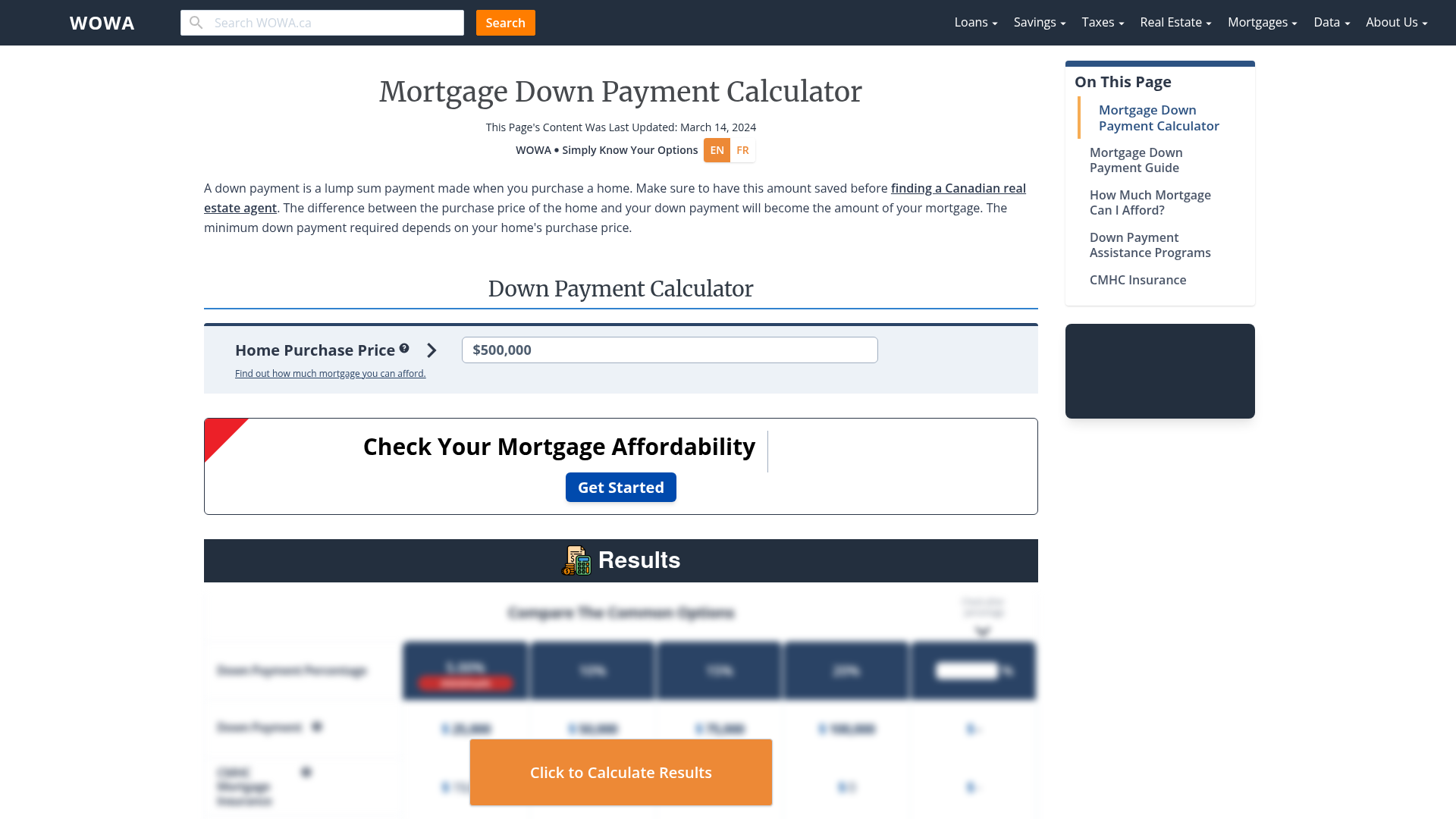

Mortgage Down Payment Calculator 2022 Mortgage Rules Wowa Ca

Pros And Cons Of Joint Mortgages Loans Canada